The coronavirus (COVID-19) hit Europe around February 2020, impacting the health of millions of people, leading to thousands of deaths. Businesses in many industries were hit and experienced lower outputs, while the stock markets plunged. Banks are affected not only by increased credit risk on loans to customers, but also by stressed deposit inflows or outflows. This has consequences from both an interest rate risk in the banking book (IRRBB) and liquidity risk perspective.

Zanders hosted a webinar on 14 May 2020 on deposit interest rate risk management in relation to the COVID-19 virus

- around 50 Treasury, ALM and Risk managers joined the session

- over 10 board members (CRO) and line managers were present

- 18 Dutch, Swiss and Danish banks were represented

On 14 May 2020, Zanders hosted a webinar for asset-liability management (ALM), risk and treasury managers of Western European banks. The goal of the webinar was to discuss this topic and provide banks with recommendations for day-to-day risk measurement and management. This white paper outlines the main insights from the webinar.

According to a poll that was held during the webinar, slightly more than half of the attendees indicated they have recently observed net inflows as a result of the COVID-19 virus. A major underlying reason for this is that retail and wholesale clients tend to be more conservative in their spending during uncertain times and that government support results in an increase in current account balances. This effect could reverse in the coming months, as government support may decrease and both retail and wholesale customers have to address their working capital to remain solvent. The primary reason indicated by respondents for increased volatility of volume is speculators taking a chance and investing in the market on the hand, and clients saving more on the other hand.

Key focus points for banks’ lines of defence on behavioural deposit risk management

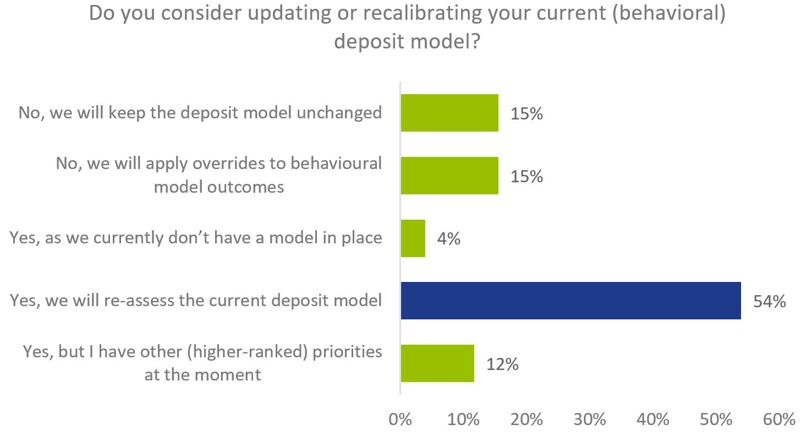

A period of stressed customer behaviour calls for a re-assessment of the models that are currently in place to measure and manage interest rate risk. This could imply a (temporary) override to incorporate the effects of COVID-19, an updated parameter set, or a complete overhaul of the existing model. More than two-thirds of respondents indicated they will indeed revisit the current behavioural deposit model in place or apply an override to model outcomes to reflect the impact of COVID-19.

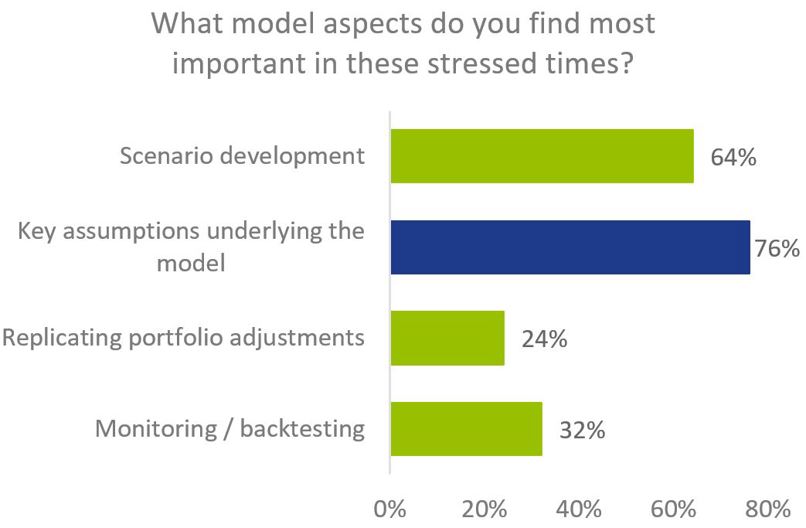

The majority of respondents in the webinar indicated their focus is on re-assessing current assumptions underlying behavioural models and refining scenario analysis (76% and 64% respectively). Around a quarter of respondents, 24% and 32%, respectively, indicated their focus is on making adjustments in the replicating portfolio and on monitoring and back-testing activities.

Arguments can be made for each of the aforementioned actions, and the current uncertainty makes it challenging to assess what changes are necessary to accurately incorporate a new reality. Banks should prevent potential adverse effects that could result from failure to apply proper behavioural modelling assumptions. These could include inaccurate hedges, increased liquidity risk and misreporting of IRRBB metrics.

We have defined focus points for banks’ lines of defence to address the consequences of COVID-19 for deposit behaviour in day-to-day risk measurement and management.

Redefine new (baseline) scenarios

As current economic outlooks are highly uncertain, so-called V-shaped, U-shaped, W-shaped and L-shaped scenarios are considered in the industry, each assuming different paces and evolvement of economic recovery. Banks can assess the development in markets rates and balance sheet development for each of the scenarios. ALM and risk managers should redefine and update market rate, client rate and deposit volume development (forecasts) depending on the economic outlook scenarios. Banks’ behavioural models should be updated to apply new baseline and (at-risk) scenarios.

Apply behavioural overwrites

Models calibrated on historical data are decreasingly representative for estimation of future behaviour, as there is yet limited data available on deposit behaviour in crisis times like the current one. Therefore, banks’ ALM and risk managers should reassess all relevant behavioural model assumptions and rely on expert judgement to define overwrites on client rate and volume forecast, the (non-)core portion and term-out.

Intervene in replication rollover (ad-hoc)

Material imbalances in replicating portfolios can occur when non-core and core deposit portions change. When current non-core portions are maintained and volatile deposit volume increases, volume inflows (non-core) will be gradually replicated into longer-term tenors over time. Banks are therefore advised to ring-fence deposit inflows in short-term replication tenors. When experiencing material outflows, replicating portfolios should be rebalanced more frequently. To prevent structural replication imbalances and overwrites, banks are recommended to recalibrate their replicating portfolio models.

Strictly monitor deposit volume development

Because COVID-19 hit Western Europe’s economies only a couple of months ago, there is no transparency on the implications of (inaccurate) behavioural assumptions during crisis times and there is no trigger yet to review behavioural models. It is recommended to monitor deposit inflow and outflow on a daily basis and assess the deviations of observations with respect to predictions. Imminent deviation from modelled outflows could trigger rebalancing, and material deviations result in (more frequent) recalibration of (behavioural) deposit models.

A call to action for ALM, risk and treasury managers

Noticing the impact of COVID-19 on deposit behaviour, a majority of ALM, risk and treasury managers at Western European banks indicated it will re-assess or overwrite its current behavioural models. They indicated their primary focus points are the key assumptions underlying the models and scenario development. Banks are advised to redefine and update baseline and at-risk scenarios for market rate, client rate and deposit volume development (forecasts) depending on the economic outlook scenarios. Key behavioural assumptions should be reassessed and banks should rely on expert judgement to define overwrites. To prevent replicating portfolio imbalances, non-core portions should reflect current volatile deposit volume and rebalancing should occur more frequently when material outflows are experienced. Finally, banks should strictly monitor predicted versus observed behaviour and recalibrate deposit models to prevent material deviations.